- The Galley

- Posts

- Why inflight catering is the weakest link in your tech stack

Why inflight catering is the weakest link in your tech stack

In partnership with

Airlines have spent the last decade modernizing almost every corner of their operation—pricing, maintenance, crew, disruption recovery—often in near real time. Yet one of the most complex and cost-sensitive functions in the business is still stuck in another era. Inflight catering remains powered by spreadsheets, static forecasts, and manual handoffs, even as everything around it accelerates.

The result is a hidden drag on efficiency, sustainability, and the passenger experience. It’s a blind spot the airline business can no longer afford to ignore.

Let’s dive in.

Why Inflight Catering Is the Weakest Link in the Airline Tech Stack

Airlines have poured billions into technology over the last decade, transforming everything from predictive maintenance to crew scheduling to customer service. Systems that used to update once a day like ticket prices now ingest and analyze data constantly, optimizing real-time demand to maximize efficiency and profits.

Yet one of the most operationally complex and mission-critical functions still lags far behind: inflight catering.

While airlines have woven data and automation into many parts of their tech stack, catering feels frozen in time. Ordering and provisioning meals remains dominated by disconnected tools: stand-alone legacy systems, spreadsheets, countless emails between planners and contractors, and last-minute phone calls to airports. Instead of operating as a modern, integrated system, catering still functions like a collection of loosely connected handoffs. It’s a fragile and slow process that feels increasingly out of step with how the rest of the airline runs.

This matters because the aviation industry is nothing like the stable, predictable one of decades past. Flight schedules now flex constantly; demand for tailored meals (from vegan and gluten-free to region-specific diets) has soared; and every airline has sustainability targets that hinge on cutting waste and emissions. Yet most catering decisions are still locked in days before departure with little room to adjust based on up-to-the-minute load or passenger forecasts. That friction shows up in predictable, measurable ways across operations.

Small inefficiencies compound fast. On flights where load factors dip unexpectedly, planes often depart with too much food on board, adding weight and burning more fuel. On high-demand sectors or last-minute gate changes, meal shortages lead to substitutions, irritated passengers, and stressed crews. Product consistency can be a guessing game across hubs and partners. These aren’t dramatic headlines, but they are pervasive: waste from untouched meals alone account for 65% of all cabin refuse.

INDUSTRY INSIDER

What Gategroup’s $2 billion IPO means for the travel sector

Gategroup, the world’s largest airline catering company, is planning a $2 billion IPO in 2026, hoping to expand its inflight catering, logistics, and retail services globally. The move could reshape service offerings for major carriers such as Emirates and Air India, while also driving broader growth in the travel and hospitality industry as global tourism rebounds. [Travel & Tour World]

What to expect at the World Travel Catering & Onboard Services Expo 2026

The World Travel Catering & Onboard Services Expo (WTCE) 2026, taking place April 14-16 in Hamburg, will expand its show with new themed zones like a dedicated Drinks Zone, a First-Time Exhibitor Village, and expert-led content designed to showcase innovations in inflight catering, passenger wellbeing, sustainability and digital transformation. [Inflight]

How to turn inflight dining into a cultural art form

All Nippon Airways (ANA) and Japan Airlines are elevating inflight dining into a cultural experience by collaborating with award-winning chefs and sommeliers to create seasonal, fine-dining menus served on handcrafted tableware that showcase Japanese culinary philosophy and regional ingredients. [Aviation A2Z]

A word from our partner

Airlines face major challenges in coordinating in-flight catering, as miscommunication between teams can lead to loading errors, delays, and wasted resources. Many still rely on outdated systems like printed documents or emails, which make real-time collaboration difficult.

Modern in-flight catering software streamlines operations by improving communication, reducing errors, and ensuring that meal provisioning runs smoothly—saving both time and money.

IFCS Aviation Galley Planner is the easiest way to monitor and control the operational functions related to inflight catering, menu planning, and galley loading.

TECH CHECK

Emirates to integrate AI with OpenAI collaboration

Emirates has entered a strategic collaboration with OpenAI to integrate advanced AI, including ChatGPT Enterprise, across its airline operations—aiming to enhance operational efficiency, innovation, and the overall customer experience. The partnership includes tailored AI literacy programs, development of practical AI use cases, and the creation of an AI Centre of Excellence to drive enterprise-wide adoption and future-focused solutions. [Aerospace Global News]

How the retail revolution is unlocking double-digit gains for airlines

Cutting-edge technologies are reshaping the airline industry, especially through modern distribution standards like NDC and ONE Order, which enable more personalized offers, streamlined travel experiences, and reduced IT complexity. Carriers are adopting service-oriented platforms that resemble e-commerce systems—with AI integration increasing revenue opportunities and operational efficiency. [IBM Institute for Business Value]

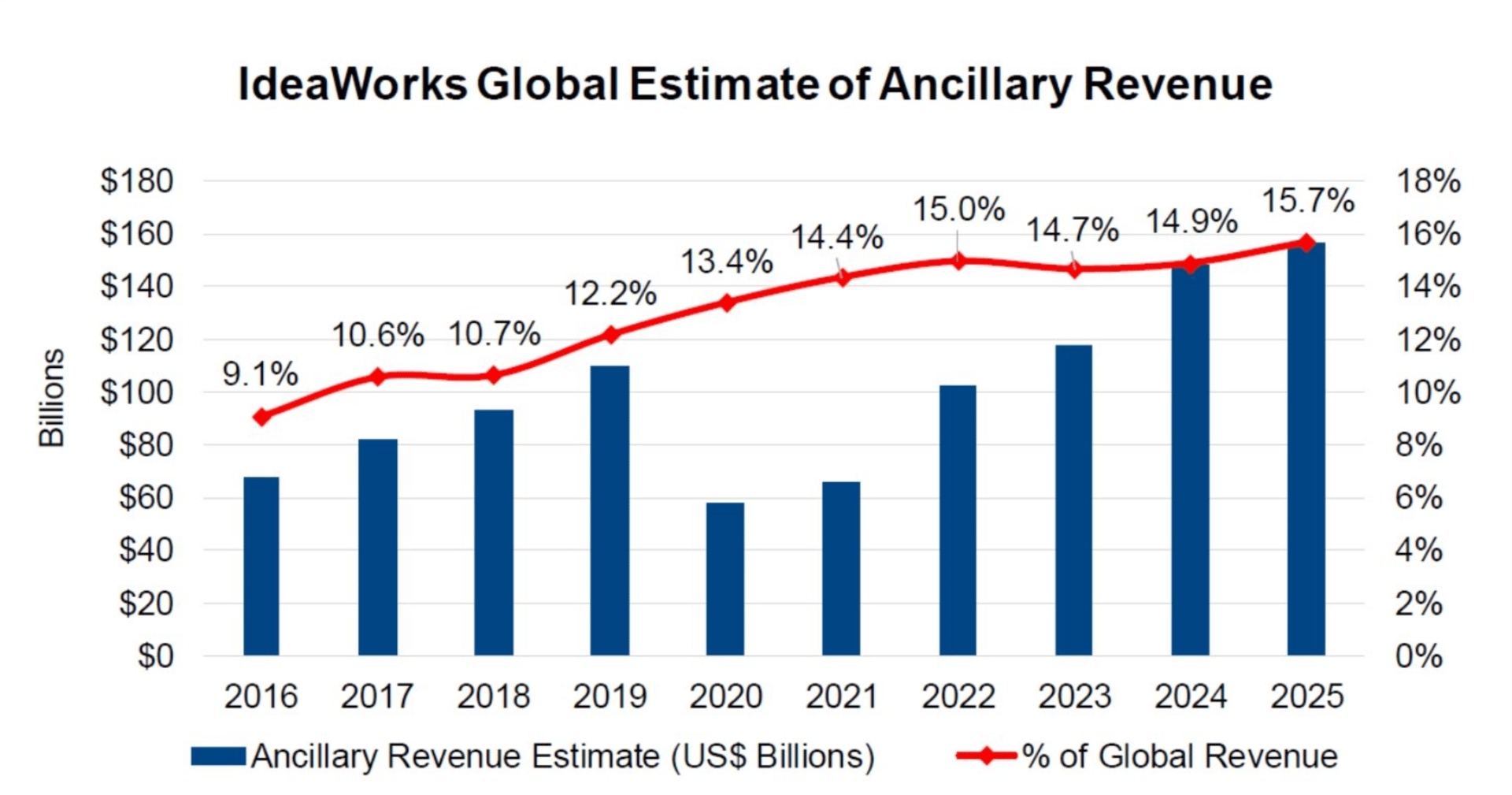

The One Chart You Need to Know

Airlines generated record $157 billion in ancillary revenue in 2025

Source: IdeaWorks Company

Airlines worldwide generated a record $157 billion (USD) in ancillary revenue in 2025, according to figures released by IdeaWorksCompany. This marks an increase from $148.4 billion in 2024 and more than double the $67.4 billion recorded in 2016. This trend highlights how complementary travel products and services have become central to the airlines’ business models, opening up new revenue streams for carriers and catering companies as well.

To see the original chart & story, click here.

We want your feedback!

What stories would you like to see covered in The Galley? What trends are on your radar?

Reach out to [email protected] with your questions / comments / feedback.